Why “When to Hire a Fractional CFO” Is One of the Hottest Searches in 2025 — And What It Means for Your Business

- FCP_Admin

- Oct 14, 2025

- 8 min read

Introduction

In the shifting economic landscape of 2025, business leaders are deeply focused on agility, cost efficiency, and data-driven decision making. One of the most commonly searched questions in the finance and startup world today is: “When should I hire a fractional CFO?” This reflects a growing recognition that accessing high-level financial leadership doesn’t always require a full-time hire — especially when the business environment remains uncertain, capital is tight, and flexibility is essential.

In this post, we’re going to explore:

Why “when to hire a fractional CFO” is trending

What current market conditions are driving that trend

Key indicators and timing cues for engaging a fractional CFO

The value proposition (and ROI) you can expect

How to structure the engagement

Real-world use cases

Tips and pitfalls

A forward look at how the role of the fractional CFO is evolving in 2025 and beyond

Why “When to Hire a Fractional CFO” Is a Trending Topic

The rise in demand for flexible C-suite solutions

Economic uncertainty and rising labor costs are pushing many businesses to reconsider the traditional approach to hiring senior executives. Rather than committing to a full-time CFO with salary, benefits, and equity, many companies are opting for a fractional or part-time model. This allows them to access top-tier financial leadership without overextending. Controllers Council+2NOW CFO+2

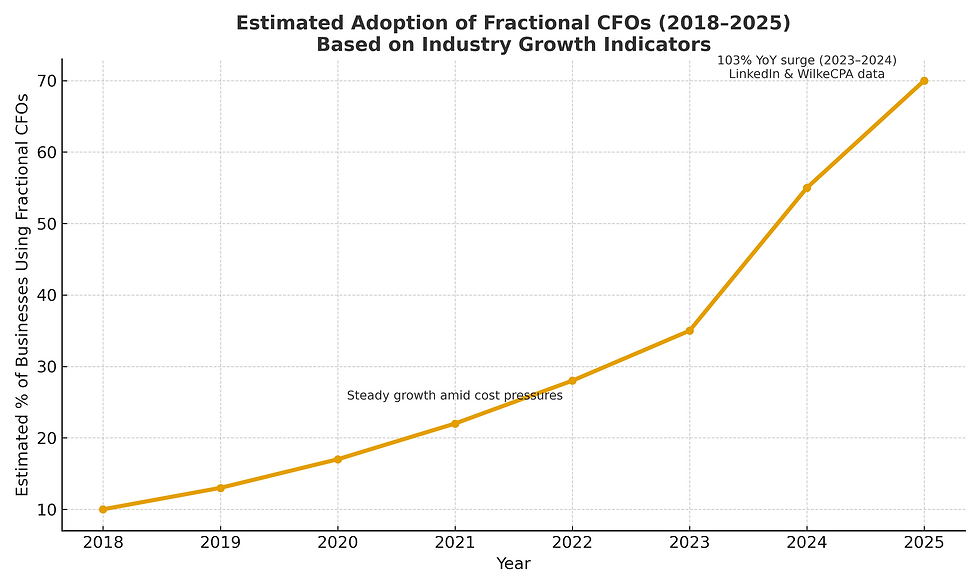

LinkedIn data and industry commentary show that “fractional” roles in the C-suite are increasingly in focus — the search volume, job listings, and conversation around fractional CFOs are all trending upward. Axios

Market sizing and growth projections

The global finance and accounting outsourcing market is projected to hit $76.36 billion by 2033, growing at ~5.75% CAGR starting in 2025. NOW CFO

Some industry players estimate the fractional CFO services market could exceed $60 billion by the end of 2025. Eightx

Many firms see fractional CFO engagements as part of a broader move toward flexible resourcing in the C-suite. NOW CFO+1

These numbers validate what many business founders, VCs, and private equity sponsors have already sensed: fractional CFOs are no longer a niche; they’re becoming a mainstream solution.

The investor / VC shift

One of the most striking data points: in 2025, roughly 83% of top-tier VCs now require professional financial leadership (or at least evidence of one) before issuing a term sheet. Rooled

In an era when investors have less patience for sloppy financials or hurried cleanup work, having a CFO — even a fractional one — becomes a signal of maturity and readiness. That makes the question of when to bring one on even more critical.

Key Market Forces Driving the Trend

To understand when it makes sense, it helps to understand why the trend is accelerating now:

Margin pressure & cost control Inflation, supply chain shocks, and rising interest rates have squeezed margins across industries. Leaders need sharper financial insight — not just bookkeeping — to survive and grow. NOW CFO+3DHJJ+3NOW CFO+3

Technological acceleration in finance Automation, AI, predictive analytics, and financial operations (FinOps) tools are enabling more sophisticated financial modeling at lower cost. A fractional CFO who knows how to leverage these tools can unlock disproportionate value. DHJJ+2NOW CFO+2

Flexible work & remote leadership models The rise of remote and distributed teams lets fractional CFOs operate at scale, supporting multiple clients from afar. This removes many of the logistical barriers that used to limit their adoption. NOW CFO+1

Higher expectations from stakeholders Lenders, investors, board members, and regulators increasingly expect real-time financial dashboards, scenario planning, risk management and better controls. Many CEOs can’t keep up alone. Medium+2NOW CFO+2

Smaller businesses reaching complexity thresholds As startups grow, they hit inflection points where basic financial systems (spreadsheets, ad hoc reporting) no longer suffice. That’s exactly when fractional leadership often becomes essential. NOW CFO+3Invedus+3Use Shiny+3

When Exactly Should You Hire a Fractional CFO? — 8 Key Indicators

Below are some tangible signals your business is ready (or past due) for fractional CFO leadership:

Indicator | What It Means | Actionable Next Step |

1. Cash flow is unpredictable | You struggle to project or manage cash over rolling 90-day windows | Bring in a CFO to build a stress-tested cash flow model |

2. You’re seeking capital (debt or equity) | You need investor-ready financials, forecasting, due diligence | Hire a fractional CFO to lead deal prep and narrative |

3. Revenue / complexity is growing rapidly | Multiple product lines, geographies, or channels are adding complexity | A CFO can unify reporting and controls |

4. Metrics matter (unit economics, CAC, LTV) | You’re under pressure to optimize financial KPIs | Use a CFO to embed metrics and analyze levers |

5. You lack internal confidence in the numbers | You question the accuracy, consistency or timeliness of financial reports | The CFO can stabilize and institutionalize reporting |

6. You need better cost/compliance controls | Manual processes, weak internal controls, or audit risk are mounting | CFO can design stronger policies and controls |

7. Board, investors, or lenders demand higher visibility | External stakeholders are pressuring you for more depth | CFO can create dashboards, scenario models, and reporting cadence |

8. You’re facing merger, acquisition or exit planning | Strategic financial modeling and risk assessment become mission-critical | CFO leads valuation, diligence, and integration planning |

If you see two or more of these flags in your organization, you’re likely overdue for bringing in a fractional CFO.

The Value Proposition & ROI of a Fractional CFO

One of the biggest concerns for any founder is: “Will I get value, and when?”

Here’s how you can frame and measure the ROI:

1. Cost savings vs. full-time

A full-time CFO might demand a six-figure salary plus benefits plus equity. A fractional CFO allows you to pay only for the hours and services you need. cfoselections.com+2NOW CFO+2

Typical hourly rates in 2025 for fractional CFOs range from $175 to $350+ per hour, depending on scope, industry, and geography. graphitefinancial If your engagement is, say, 20–60 hours a month, the total cost may pale in comparison with hiring full-time, especially when factoring recruiting, severance risk, benefits, and turnover overhead.

2. Enhanced decision-making — better capital allocation

A skilled CFO brings forward-looking insight, scenario analysis, and capital allocation discipline. That means fewer costly missteps, optimized investment, and smarter growth decisions.

3. Reduced risk & better controls

By embedding internal controls, oversight, and audit-ready processes, you reduce risk (fraud, compliance, calculation errors). That’s hard to quantify, but extremely valuable.

4. Faster execution & scalability

With a CFO in place, you can scale more confidently, onboard new business units, or expand internationally — often without needing a step-function increase in finance headcount.

5. Investor confidence and deal outcomes

When approaching investors or buyers, having strong financial leadership (even fractional) can increase valuation, reduce discounting, and speed up diligence processes.

For many firms, a fractional CFO pays for itself within months — sometimes even weeks — when preventing a misstep, closing a deal, or streamlining operations.

How to Structure a Fractional CFO Engagement

To get maximum impact, you’ll want to think carefully about how you structure the working relationship:

Engagement models

Monthly retainer — A fixed number of hours per month for a set fee (e.g., 20–60 hours).

Tiered / scalable plan — A base retainer plus incremental hours as needed.

Project-based — For finite work (e.g., fundraising, systems migrations, M&A prep).

Hybrid — Retainer plus success or outcome-based bonuses (e.g. KPI yield, fundraising success).

Scope & deliverables

Be explicit about what you expect:

Regular financial reporting, dashboards, KPIs

Forecasting, modeling & scenario planning

Cash-flow management & treasury oversight

Cost structure optimization

Capital raising / debt structuring

Internal controls, compliance, audit readiness

Coaching or mentoring of internal finance team

Onboarding & ramping

Give the fractional CFO access to your systems, historical data, conversations with investors/board, and organizational context. Expect a 4–8 week ramp-up. Use that time to align on priorities, set targets, and build trust.

Communication cadence

Set weekly touchpoints, monthly financial reviews, and quarterly strategic planning sessions. Dashboards should be real-time or near real-time, not something that lags weeks behind.

Term & exit provisions

Define minimum notice (e.g., 60–90 days), conditions for termination, and knowledge-transfer obligations. This avoids operational disruption.

Use Cases & Real-World Scenarios

Here are illustrative examples of how fractional CFOs are being used across sectors in 2025:

Tech / SaaS startup pre-Series A: A startup with initial traction but limited financial discipline brings in a fractional CFO months before fundraising. The CFO builds unit economics models, tightens CAC payback, and conducts scenario modeling to support valuation arguments.

Consumer / DTC brand scaling fast: A DTC brand with multiple SKUs, SKUs shifts, and growing marketplaces engages a fractional CFO to centralize P&L by channel, negotiate terms with distributors, and model working capital needs.

Healthcare / MedTech spinout: The founder’s strength is product development, not finance. A fractional CFO helps with grant accounting, compliance, reimbursement modeling, and investor reporting.

PE / Portfolio operations: A private equity firm uses fractional CFOs across multiple portfolio companies to standardize reporting, centralize back-office functions, and accelerate value creation.

Nonprofit with growth phase: A nonprofit engaging in strategic expansion or capital campaign uses fractional CFO leadership to improve budgeting, donation modeling, and audit readiness.

Each scenario looks different — the key is aligning the CFO’s skills with your stage, challenges, and growth ambitions.

Tips & Pitfalls to Watch Out For

Tips

Prioritize domain or industry experience (e.g. SaaS, manufacturing, healthcare).

Ensure cultural fit and “financial translator” ability — the CFO must communicate well with non-finance stakeholders.

Start with a focused initial scope; expand as trust builds.

Use dashboards accessible by leadership (not just finance) to drive alignment.

Treat the fractional CFO as a strategic partner, not just a contractor.

Pitfalls

Vague scope: Without clarity, projects drift and value gets diluted.

Overload: Asking a fractional CFO to cover everything from bookkeeping to investor VC strategy is a recipe for burnout or underdelivery.

Poor data hygiene: If your books are messy, the CFO wastes time cleaning instead of adding insight.

Undervaluing the ramp-up period: Expect the first few weeks to be heavy in learning, not execution.

Failing to internalize knowledge: Always plan for handoffs or internal capacity building so the CFO engagement doesn’t create a permanent external dependency.

The Future of the Fractional CFO Role: What’s Next in 2025 and Beyond

As we look ahead, here are some shifts likely to shape fractional CFO practice and expectations:

AI, predictive analytics, and augmented finance CFOs will increasingly use AI tools to augment forecasting, anomaly detection, scenario planning, and insight generation. The fractional CFO who masters these tools will outperform peers. NOW CFO+2DHJJ+2

Embedded finance & FinOps convergence Finance will integrate more tightly with ops, sales, procurement, and product teams. CFOs will often sit across functions and have to monitor cross-functional metrics in real time. DHJJ+1

Fractional “twinning” and fractional networks Some firms adopt a model where a single fractional CFO collaborates with fractional CFO “twins” or specialized specialists (e.g., one for mergers, one for analytics) as the business demands. The Times+2LinkedIn+2

Outcome-based compensation Some engagements may evolve to include success fees tied to metrics such as fundraising multiples, EBITDA improvement, or margin expansion.

Greater penetration into non-traditional segments Beyond startups and SMEs, more nonprofits, governmental agencies, and small industrial firms may adopt fractional CFOs to boost financial maturity.

Stronger differentiation & specialization Fractional CFOs will increasingly specialize by vertical (e.g. fintech, healthcare) or by problem (e.g. turnaround, M&A) to differentiate in a more crowded market. LinkedIn+1

Conclusion

If you find yourself googling “when should I hire a fractional CFO”, you’re not alone — and you're asking one of the most important questions a growing company can ask in 2025.

The window of optimal impact is often before things become dire, but after complexity has outgrown basic financial processes. When the indicators above begin to flicker, it’s time to bring in a strategic financial partner who can elevate forecasting, risk management, capital strategy, and decision-making — all while keeping costs flexible.

At Fractional CFO Partners, we specialize in helping companies navigate that inflection point. If you’d like help diagnosing which signals are most relevant for your business, or designing a scope for your first fractional CFO engagement, let’s talk.

Comments